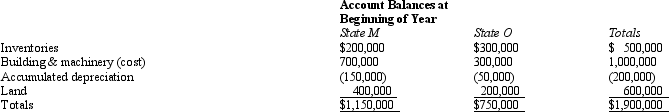

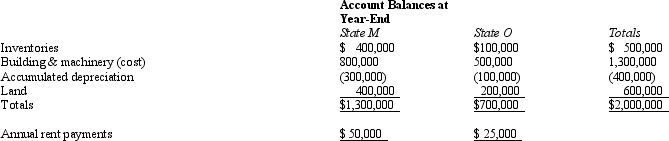

Bert Corporation,a calendar-year taxpayer,owns property in States M and O.Both M and O require that the average value of assets be included in the property factor.M requires that the property be valued at its historical cost,and O requires that the property be included in the property factor at its net depreciated book value.

Bert's M property factor is:

Bert's M property factor is:

A) 75.0%.

B) 66.7%.

C) 64.9%.

D) 64.5%.

Correct Answer:

Verified

Q61: In most states, a limited liability company

Q69: Net Corporation's sales office and manufacturing plant

Q70: Helene Corporation owns manufacturing facilities in States

Q73: José Corporation realized $600,000 taxable income from

Q75: When the taxpayer has exposure to a

Q77: Guilford Corporation is subject to franchise tax

Q78: The throwback rule requires that:

A)Sales of tangible

Q78: Judy,a regional sales manager,has her office in

Q79: A state sales tax usually falls upon:

A)Sales

Q82: In the broadest application of the unitary

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents