Determine Bowl's sales factors for States K,M,and N.

Bowl Corporation's manufacturing facility,distribution center,and retail store are located in State K.Bowl sells its products to residents located in States K,M,and N.

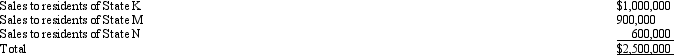

Sales to residents of K are conducted through a retail store.Sales to residents of M are obtained by Bowl's sales representative,who has the authority to accept and approve sales orders.Residents of N can purchase Bowl's product only if they place an order online and arrange to take delivery of the product at Bowl's shipping dock.Bowl's sales were as follows.

Bowl's activities within the three states are limited to those described above.All of the states have adopted a throwback provision and utilize a three-factor apportionment formula under which sales,property,and payroll are equally weighted.K sources dock sales to the destination state.

Bowl's activities within the three states are limited to those described above.All of the states have adopted a throwback provision and utilize a three-factor apportionment formula under which sales,property,and payroll are equally weighted.K sources dock sales to the destination state.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q109: Overall tax liabilities typically (increase/decrease) if the

Q115: In unitary states, a(n) _ provision permits

Q116: Under common terminology, a unitary group files

Q121: Pail Corporation is a merchandiser.It purchases overstock

Q124: Compute Quail Corporation's State Q taxable income

Q126: Node Corporation is subject to tax only

Q127: Hermann Corporation is based in State A

Q131: A state sales/use tax is designed to

Q142: List which items are included in the

Q199: Sylvia spends time working at the offices

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents