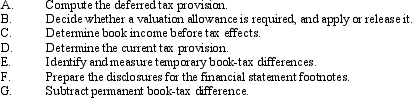

You are assisting LipidCo,a U.S.corporation subject to GAAP,to determine its current-year book expense for income taxes.The following represent the steps that you will take in making this computation.Put the steps into the correct order.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q61: You are the tax adviser to a

Q62: Book-tax differences can be explained in part

Q77: Amelia,Inc. ,is a domestic corporation with the

Q78: Black,Inc. ,is a domestic corporation with the

Q79: At the beginning of the year,Jensen Inc.

Q80: Black,Inc. ,is a domestic corporation with the

Q81: How does an auditor determine whether a

Q83: After applying the balance sheet method to

Q92: Placard, a multinational corporation based in the

Q93: A corporation's taxable income almost never is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents