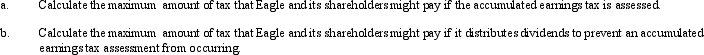

Eagle,Inc.recognizes that it may have an accumulated earnings tax problem.According to its calculation,Eagle anticipates it has accumulated taxable income,before reduction for dividends paid,of $600,000 in 2012.Assume that its shareholders are in the 35% marginal tax bracket.

Correct Answer:

Verified

Q103: List some techniques which can be used

Q107: Walter wants to sell his wholly owned

Q110: What special adjustment is required in calculating

Q113: Ashley has a 65% interest in a

Q114: Lee owns all the stock of Vireo,Inc.

Q116: Sam and Vera are going to establish

Q116: Under what circumstances, if any, do the

Q117: List some techniques for reducing and/or avoiding

Q118: Why does stock redemption treatment for an

Q129: Do the § 465 at-risk rules apply

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents