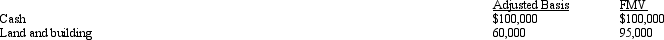

Marsha is going to contribute the following assets to a business entity in exchange for an ownership interest.

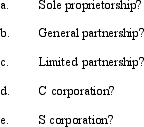

What are the tax consequences of the contribution to Marsha if the business entity is a(n):

What are the tax consequences of the contribution to Marsha if the business entity is a(n):

Correct Answer:

Verified

Q88: How can double taxation be avoided or

Q102: What tax rates apply for the AMT

Q105: Why are S corporations not subject to

Q105: With respect to special allocations, is the

Q109: Aubrey has been operating his business as

Q123: Do the § 465 at-risk rules treat

Q126: A business entity has appreciated land (basis

Q128: Agnes owns a sole proprietorship for which

Q129: Do the § 465 at-risk rules apply

Q133: To which of the following entities does

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents