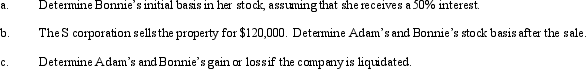

Individuals Adam and Bonnie form an S corporation,with Adam contributing cash of $100,000 for a 50% interest and Bonnie contributing appreciated ordinary income property with an adjusted basis of $20,000 and a fair market value of $100,000.

Correct Answer:

Verified

Q117: Advise your client how income, expenses, gain,

Q122: Compare the distribution of property rules for

Q140: Estela,Inc. ,a calendar year S corporation,incurred the

Q142: Blue Corporation elects S status effective for

Q145: Explain how the domestic production activities deduction

Q148: You are a 60% owner of an

Q152: Outline the requirements that an entity must

Q156: On December 31, 2011, Erica Sumners owns

Q157: During 2012, Rasic, the sole shareholder of

Q159: List some of the separately stated items

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents