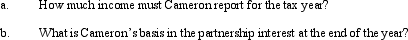

In the current year,the CAR Partnership received revenues of $400,000 and paid the following amounts: $160,000 in rent,utilities,and salaries;a $40,000 guaranteed payment to partner Ryan;$20,000 to partner Amy for consulting services;and a $40,000 distribution to 25% partner Cameron.In addition,the partnership realized a $12,000 net long-term capital gain.Cameron's basis in his partnership interest was $60,000 at the beginning of the year,and included his $25,000 share of partnership liabilities.At the end of the year,his share of partnership liabilities was $15,000.

Correct Answer:

Verified

Q88: The MOP Partnership is involved in leasing

Q92: Greg and Justin are forming the GJ

Q93: The MOG Partnership reports ordinary income of

Q108: Which of the following is not a

Q114: The LN partnership reported the following items

Q127: Crystal contributes land to the newly formed

Q133: During the current year, MAC Partnership reported

Q167: In the current year, Derek formed an

Q183: Sarah contributed fully depreciated ($0 basis) property

Q204: Sharon and Sue are equal partners in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents