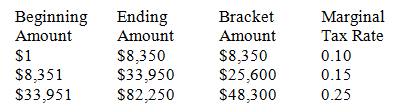

Following is a partial 2009 personal income tax schedule for a single filer:

Taxable Income

-The maximum dollar amount of income taxes in the $33,951-$82,250 "bracket" paid by a single filer with taxable income of $77,100 would be:

A) $150

B) $835

C) $3,840

D) $4,675

E) $12,075

Correct Answer:

Verified

Q46: Which form of business organization typically offers

Q50: The rules and procedures established to govern

Q53: Following is a partial 2012 corporate income

Q54: Based on 2009 tax schedules,the highest marginal

Q54: The average tax rate for a corporation

Q55: Based on 2009 tax schedules,the first dollar

Q58: Based on 2009 tax schedules,the first dollar

Q59: The average tax rate for a corporation

Q59: Based on 2009 tax schedules,the highest marginal

Q61: In a general partnership,legal action that treats

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents