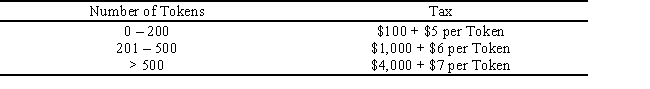

The mythical country of Traviola imposes a tax based on the number of gold Tokens each taxpayer owns at the end of each year per the following schedule:

Traviola's Token tax is a

A) proportional tax.

B) regressive tax.

C) progressive tax.

D) value-added tax.

Correct Answer:

Verified

Q42: Oliver pays sales tax of $7.20 on

Q49: Lee's 2016 taxable income is $88,000 before

Q51: The Federal income tax is a

A)revenue neutral

Q53: Sally is a single individual.In 2016,she receives

Q53: Employment taxes are

A)revenue neutral.

B)regressive.

C)value-added.

D)progressive.

E)proportional.

Q55: Elrod is an employee of Gomez Inc.During

Q56: Indicate which of the following statements concerning

Q56: Heidi and Anastasia are residents of the

Q58: Taxpayer A pays tax of $3,300 on

Q59: Alan is a single taxpayer with a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents