The mythical country of Woodland imposes two taxes:

Worker tax: Employers withhold ten percent of all wages and salaries.If taxable income as reported on the employee's income tax return is greater than $40,000,an additional 5% tax is levied on all income.

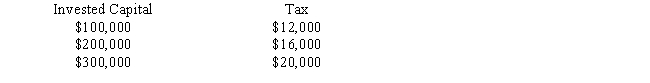

Business tax: All businesses pay a tax on invested capital based on a valuation formula.The tax computed for three different amounts of invested capital is provided below:

According to the definitions in the text:

I.The worker tax is a regressive tax rate structure.

II.The business tax is a progressive tax rate structure.

III.The worker tax is a progressive tax rate structure.

IV.The business tax is a regressive tax rate structure.

A) Statements I and III are correct.

B) Statements II and III are correct.

C) Only statements III is correct.

D) Statements I and IV are correct.

E) Statements III and IV are correct.

Correct Answer:

Verified

Q43: Jered and Samantha are married.Their 2016 taxable

Q44: Betty is a single individual.In 2016,she receives

Q46: Katarina,a single taxpayer,has total income from all

Q49: Lee's 2016 taxable income is $88,000 before

Q51: The Federal income tax is a

A)revenue neutral

Q53: Employment taxes are

A)revenue neutral.

B)regressive.

C)value-added.

D)progressive.

E)proportional.

Q53: Sally is a single individual.In 2016,she receives

Q54: A tax provision has been discussed that

Q58: Taxpayer A pays tax of $3,300 on

Q60: Greg pays sales tax of $7.20 on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents