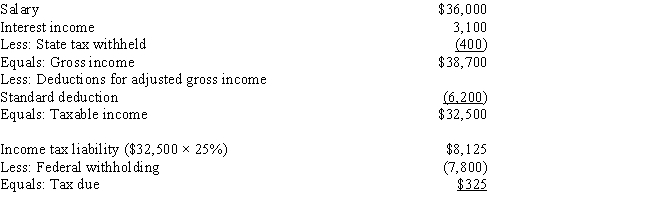

Rosemary is single and works for Big B Corporation.Her only income consists of her Big B salary and interest on a savings account.During the year,she has $400 withheld from her salary for state income taxes and $7,800 for federal income taxes.Her brother provides her with the following calculation of her taxable income and income tax liability:

Explain the errors that Rosemary 's brother has made in calculating her taxable income and/or her income tax liability.A recalculation is not necessary,but you must adequately explain the errors that were made.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q104: Match each term with the correct statement

Q111: Betty hires Sam to prepare her federal

Q112: On December 28,2016,Doris and Dan are considering

Q114: Pedro,a cash basis taxpayer,would like to sell

Q116: Match each term with the correct statement

Q118: Nora and Nathan work for Cozener Construction

Q119: Harriet and Harry are married and have

Q120: All tax practitioners who prepare tax returns

Q128: Raquel is a recent law school graduate.

Q147: Ed travels from one construction site to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents