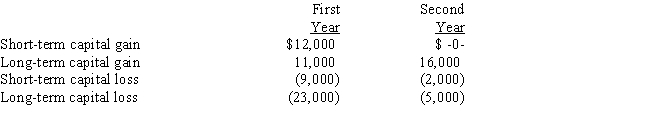

Given below are Mario's capital gains and losses for two consecutive years.What is the effect of the capital gains and losses on Mario's taxable income for each year?

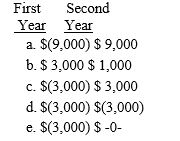

Correct Answer:

Verified

Q86: Elise sells a painting that has a

Q88: Nora receives a salary of $55,000 during

Q89: Jerry is a furniture salesman for Ashland's

Q93: Helena and Irwin are married taxpayers who

Q96: Benjamin has the following capital gains and

Q99: Dahlia rents a condo owned by Bonnie.

Q100: Elizabeth sells a painting that has a

Q100: Andrea has the following capital gains and

Q101: Which of the following tax rates applies

Q110: Willis is a cash basis taxpayer who

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents