Shasta has the following capital gains and losses and Qualified dividend income during the current year:  If Shasta's marginal tax rate is 33%,what is the effect of the above on her taxable income and income tax liability?

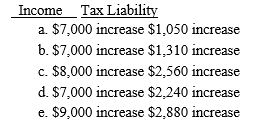

If Shasta's marginal tax rate is 33%,what is the effect of the above on her taxable income and income tax liability?

Correct Answer:

Verified

Q77: Which of the following interest-free loans is

Q80: How much gross income does Faith have

Q83: Chip,a single individual has two sales of

Q84: Ira sells two of his personal automobiles,

Q85: Patti sells a painting that has a

Q87: Which of the following items is a

Q88: Given below are Belinda's capital gains and

Q91: Which of the following items is not

Q93: Stephen is a furniture salesman for Foster's

Q95: Roberto is a furniture salesman for Gerald's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents