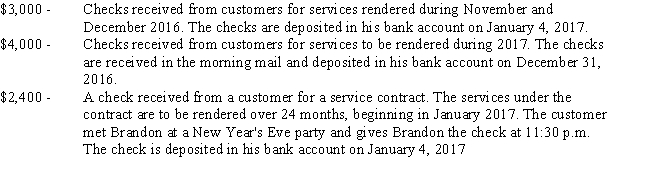

Brandon is the operator and owner of a cleaning service who uses the cash method of accounting.He receives the following payments on December 31,2016,the last business day of his tax year:

How much of the $9,400 collected by Brandon on December 31 must be included in his 2016 gross income?

A) $2,400

B) $3,000

C) $5,400

D) $7,000

E) $9,400

Correct Answer:

Verified

Q101: The income tax concept that is primarily

Q106: Under the deferral method of accounting for

Q109: The cash method of accounting for income

Q114: Sanderson has the following capital gains and

Q115: Dunbar,a single taxpayer,purchased 300 shares of Sweetwater,Inc.,stock

Q115: Southview Construction Company enters into a contract

Q116: Which of the following payments received on

Q120: Donna owns a cleaning service.Reed,a customer,receives Donna's

Q129: Dan is the owner of VHS Video's

Q142: Melissa is currently working with her divorce

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents