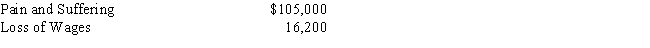

While staying at Vail Heights Resort,Jared falls over a pool cleaning vacuum hose left near the edge of the swimming pool,and suffers severe internal injuries.As part of the settlement,Jared receives the following amounts:  How much of the settlement must be included in Jared's Gross Income?

How much of the settlement must be included in Jared's Gross Income?

A) $- 0 -

B) $16,200

C) $60,600

D) $105,000

E) $121,200

Correct Answer:

Verified

Q50: Sylvia is a United States citizen who

Q58: Ramona's employer pays 100% of the cost

Q59: David,an employee of Lima Corporation,is a U.S.citizen

Q62: The income tax treatment of damages received

Q66: Returns of human capital

I.are excluded from gross

Q69: Francisco's employer establishes Health Savings Accounts (HSA's)

Q70: Hannah is an employee of Bolero Corporation.Bolero

Q71: During the Chili Company Christmas party, Alex

Q74: The tax law allows the exclusion of

Q75: Arthur's employer establishes Health Savings Accounts (HSAs)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents