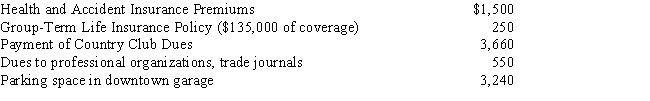

Summary Problem: Ralph,age 44,is an account executive for Cobb Advertising,Inc.Ralph's annual salary is $90,000.Other benefits paid by Cobb Advertising were:

In addition to the benefits above,Cobb Advertising has a qualified pension plan into which employees can contribute (and Cobb matches)up to 5% of their annual salary.Ralph contributes the maximum allowable to the plan.

Ralph has never been able to itemize his allowable personal deductions (i.e.,he always uses the standard deduction).In 2016,Ralph receives a refund of $300 of his 2015 State income taxes and a 2015 Federal tax refund of $400.

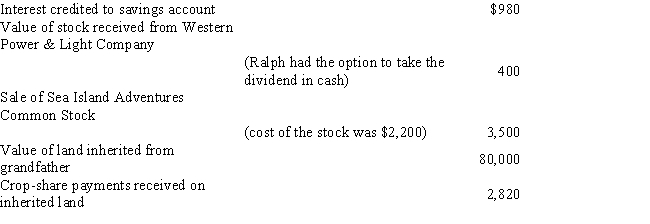

Other sources of income:

Required: Compute Ralph's 2016 gross income.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q102: Match each statement with the correct term

Q105: Match each statement with the correct term

Q106: Match each statement with the correct term

Q116: Match each statement with the correct term

Q129: Summary Problem: Tommy,a single taxpayer with no

Q132: Match each statement with the correct term

Q135: Sergio owns Sergio's Auto Restoration as a

Q136: Match each statement with the correct term

Q141: Carson, age 34 and single, is an

Q158: Isabel,age 51 and single,is an electrical engineer

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents