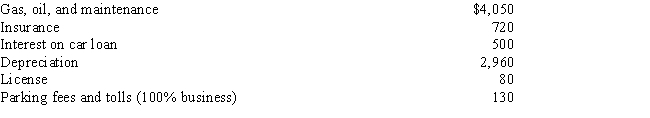

Penny owns her own business and drives her car 12,000 miles a year for business and 3,000 miles a year for commuting and personal use.She wants to claim the largest tax deduction possible for business use of her car.Her total expenses related to her auto for 2016 are as follows:

Penny's total deduction for business use of the auto in 2016 is:

A) $6,378

B) $6,778

C) $6,850

D) $6,610

E) $7,310

Correct Answer:

Verified

Q21: Julie travels to Mobile to meet with

Q23: Arlene,a criminal defense attorney inherits $500,000 from

Q24: Which of the following business expenses is/are

Q25: Donna is an audit supervisor with the

Q27: Which of the following business expenses is/are

Q28: Carlotta pays $190 to fly from Santa

Q28: Jason travels to Miami to meet with

Q30: In 2016,Eileen,a self-employed nurse,drives her car 20,000

Q31: Mercedes is an employee of MWH company

Q55: Francine operates an advertising agency. To show

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents