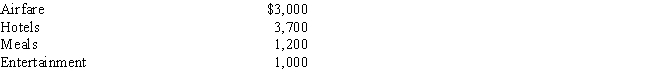

Joline works as a sales manager for the Washington Manufacturing Company.Although the company has an accountable reimbursement plan,as a cost containment measure the company will only reimburse its sales personnel for 80% of their business expenses.During the year,Joline incurred the following business expenses:

If Joline's adjusted gross income is $62,000,what amount can Joline deduct as a miscellaneous itemized deduction?

A) $320

B) $540

C) $890

D) $1,560

E) $1,780

Correct Answer:

Verified

Q66: Deductions for adjusted gross income include

I.Transportation of

Q66: Winslow owns a residential rental property with

Q78: Walter recently received a notice of an

Q78: Which of the following legal expenses paid

Q86: Brenda travels to Cleveland on business for

Q86: Mathew works for Levitz Mortgage Company.The company

Q89: Margaret is single and is a self-employed

Q91: Rhonda and Ralph are married. Rhonda earns

Q93: Richard is a sales person for Publix

Q95: Kyle is married and a self-employed landscaper.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents