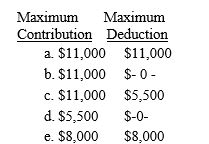

Dan and Dawn are married and file a joint return.During the current year,Dan had a salary of $30,000 and Dawn had a salary of $36,000.Both Dan and Dawn are covered by an employer-sponsored pension plan.Their adjusted gross income for the year is $95,000.Determine the maximum IRA contribution and deduction amounts.

Correct Answer:

Verified

Q110: Alex and Alicia are married and have

Q110: Fred and Irma are married with salaries

Q112: Kevin,single,is an employee of the Colonial Company

Q113: Arturo and Josephina are married with salaries

Q116: Mollie is single and is an employee

Q117: Margie is single and is an employee

Q118: Victor is single and graduated from Wabash

Q119: Marshall and Michelle are married with salaries

Q121: Which of the following is (are)correct concerning

Q131: Carla changes jobs during the year and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents