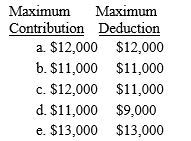

Carl,age 59,and Cindy,age 49,are married and file a joint return.During the current year,Carl had a salary of $41,000 and Cindy had a salary of $35,000.Both Carl and Cindy are covered by an employer-sponsored pension plan.Their adjusted gross income for the year is $94,000.Determine the maximum IRA contribution and deduction amounts.

Correct Answer:

Verified

Q98: Natasha is an employee of The Johnson

Q99: Chelsea is an employee of Avondale Company.Chelsea's

Q101: Mark and Cindy are married with salaries

Q102: Homer and Marge are married and have

Q105: Karen is single and graduated from Marring

Q107: Laura and Jason are married and have

Q107: Jay obtains a new job in Boston

Q108: Fred and Flossie are married and their

Q114: Aaron is a 34-year-old head of household

Q118: Carlos is single and has a 7

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents