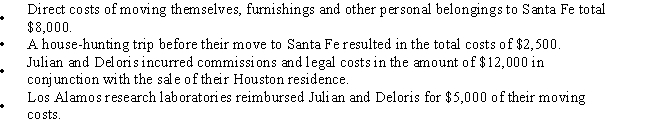

Julian and Deloris move during the current year from their home in Houston to Santa Fe.Julian was a rocket scientist with NASA in Houston and has accepted a new job with the Los Alamos research lab near Santa Fe.Moving expenses and reimbursement information are presented below.  What is their Moving Expense deduction?

What is their Moving Expense deduction?

A) $17,500 deduction from AGI.

B) $8,000 deduction for AGI.

C) $10,500 deduction from AGI.

D) $3,000 deduction for AGI.

E) $22,500 decution from AGI.

Correct Answer:

Verified

Q128: Match each statement with the correct term

Q129: For each of the following situations, determine

Q132: Match each statement with the correct term

Q135: For each of the following situations

Q138: For each of the following situations explain

Q139: Match each statement with the correct term

Q139: For each of the following situations,determine whether

Q140: Match each statement with the correct term

Q146: Amanda is the president and 60% owner

Q148: Sally and Kelly are both enrolled in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents