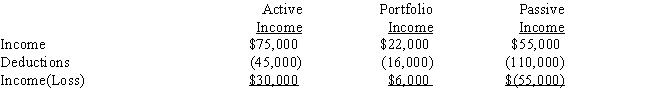

If a taxpayer has the following for the current year:

I.If the taxpayer is a regular corporation,taxable income from the three activities is a loss of $19,000.

II.If the taxpayer is an individual and the passive income is related to a rental real estate activity in which the taxpayer is an active participant,taxable income is $11,000.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

Correct Answer:

Verified

Q21: Jose, Mahlon, and Eric are partners in

Q22: Which of the following must be classified

Q25: A passive activity

I.includes any trade or business

Q29: During the year, Aimee reports $30,000 of

Q32: During 2016,Pamela worked two "jobs." She performed

Q32: Janine is an engineering professor at Southern

Q36: Travis is a 30% owner of 3

Q39: Nancy is the owner of an apartment

Q40: A taxpayer had the following for the

Q50: Rose has an adjusted gross income of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents