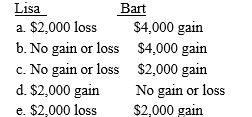

Lisa sells some stock she purchased several years ago for $10,000 to her brother Bart for $8,000.One year later Bart sells the stock for $12,000.The tax consequences to Lisa and Bart are:

Correct Answer:

Verified

Q61: Melinda and Riley are married taxpayers. During

Q62: Which of the following losses are generally

Q65: During the current year, Schmidt Corporation has

Q66: Which of the following losses are generally

Q70: Which of the following events is a

Q71: Aunt Bea sold some stock she purchased

Q72: Gomez, a self-employed consultant, is involved in

Q73: Mario's delivery van is completely destroyed when

Q76: In April of the current year, Speedy

Q78: Jennifer's business storage shed is damaged by

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents