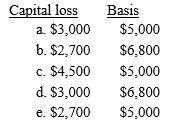

Sylvia owns 1,000 shares of Sidney Sails,Inc.,for which she paid $18,000 several years ago.On March 15,she purchases 400 additional shares for $5,000.Sylvia sells the original 1,000 shares for $13,500 on April 1.These are her only stock transactions during the year.Sylvia's capital loss deduction for the current year and her basis in the new shares are:

Correct Answer:

Verified

Q84: The Ottomans own a winter cabin in

Q90: Hamlet,a calendar year taxpayer,owns 1,000 shares of

Q92: Willie sells the following assets and realizes

Q94: The wash sale provisions apply to which

Q94: Jerome owns a farm,which has three separate

Q98: A taxpayer has the following income (losses)for

Q99: During the year,Shipra's apartment is burglarized and

Q100: Tyrone is the president of JWH Manufacturing

Q113: Why did Congress enact the at-risk rules?

Q119: If a corporation incurs a net operating

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents