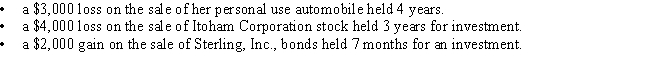

During the current year,Cathy realizes  Determine the tax consequences of these events.

Determine the tax consequences of these events.

A) Cathy deducts a $5,000 net capital loss.

B) Cathy deducts a $3,000 net capital loss.

C) Cathy deducts a $2,000 net capital loss.

D) Cathy deducts a $1,000 net capital loss.

E) Cathy deducts a $7,000 net capital loss.

Correct Answer:

Verified

Q81: The wash sale provisions apply to which

Q82: Erline begins investing in various activities during

Q85: Samantha sells the following assets and realizes

Q88: Olivia sells some stock she purchased several

Q90: Hamlet,a calendar year taxpayer,owns 1,000 shares of

Q94: During the year, Daniel sells both of

Q94: Jerome owns a farm,which has three separate

Q108: Maryanne is the senior chef for Bistro

Q109: Discuss the difference(s) between the real estate

Q116: Ronald is exploring whether to open a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents