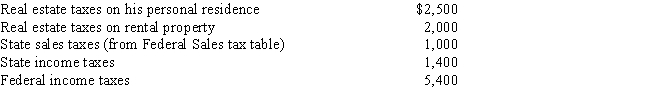

Ronald pays the following taxes during the year:

What is the amount Ronald can deduct for taxes as an itemized deduction for the year?

A) $3,500

B) $3,900

C) $4,900

D) $6,900

E) $12,300

Correct Answer:

Verified

Q62: Baylen, whose adjusted gross income is $60,000,

Q63: Carlyle purchases a new personal residence for

Q68: Certain interest expense can be carried forward

Q70: Linc,age 25,is single and makes an annual

Q75: Louise makes the following contributions during the

Q75: Randolph borrows $100,000 from his uncle's bank

Q81: Julius is an employee of a large

Q82: Orrill is single and has custody of

Q82: Smokey purchases undeveloped land in 1999 for

Q83: Cecelia is a loan officer for The

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents