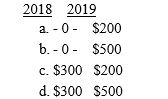

Dustin buys 200 shares of Monroe Corporation common stock on December 1,2015,for $2,000.He buys an additional 200 shares for $1,800 on December 23,2016.On December 28,2016,Dustin sells the first 200 shares for $1,700.He sells the last 200 for $1,600 on June 15,2017.What is (are)the amount(s)and the year of recognition of losses that Dustin can recognize?

Correct Answer:

Verified

Q64: On February 3 of the current year,

Q67: Dana purchases an automobile for personal use

Q69: During 2006,Charles purchased 1,000 shares of Ryan

Q70: Tony died on April 5,2016.As part of

Q71: Ludwig died on April 5,2016.As part of

Q71: Terri owns 1,000 shares of Borneo Corporation

Q74: Kim owns a truck that cost $35,000

Q76: Sara constructs a small storage shed for

Q81: Indicate the classification of each of the

Q82: Determine the adjusted basis of the following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents