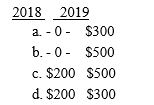

Reiko buys 200 shares of Saratoga Corporation common stock on December 10,2015,for $2,000.He buys an additional 200 shares for $1,800 on December 23,2016.On December 28,2016,Reiko sells 100 of the first 200 shares for $800.He sells the remaining 300 shares for $2,500 on November 15,2017.What is(are)the amount(s)and the year of recognition of losses that Reiko can recognize?

Correct Answer:

Verified

Q71: Terri owns 1,000 shares of Borneo Corporation

Q74: Kim owns a truck that cost $35,000

Q76: Sara constructs a small storage shed for

Q79: Mitaya purchased 500 shares of Sundown Inc.,common

Q82: Determine the adjusted basis of the following

Q82: Perry inherits stock from his Aunt Margaret

Q89: Match each statement with the correct term

Q97: Match each statement with the correct term

Q100: Match each statement with the correct term

Q105: Samantha receives 100 shares of Burnet Corporation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents