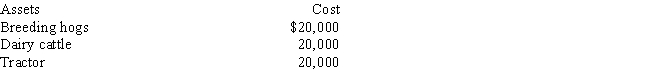

Determine the MACRS cost recovery deductions for 2016 and 2017 on the following assets that were purchased for use in a farming business on July 15,2016.The taxpayer does not wish to use the Section 179 election.

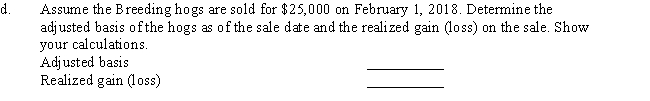

a.Breeding hogs depreciation:Total 2016 Breeding hogs Cost Recovery Deduction (show your calculations)Total 2017 Breeding hogs Cost Recovery Deduction (show your calculations)

b.Dairy cattle depreciation:Total 2016 Dairy Cattle Cost Recovery Deduction (show your calculations)Total 2017 Dairy Cattle Cost Recovery Deduction (show your calculations)

c.Tractor depreciation:Total 2016 Tractor Cost Recovery Deduction (show your calculations)Total 2017 Tractor Cost Recovery Deduction (show your calculations)

Correct Answer:

Verified

Total 2016 Breeding hogs Cost Recover...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q86: Match each statement with the correct term

Q91: Cost recoverable intangible properties include

I.Uranium ore.

II.Patents.

III.Agreements not

Q92: Charles purchases an interest in a uranium

Q94: Rand Company purchases and places into service

Q94: Annie owns a mine, which cost her

Q95: In June 2015,Chase purchases a new car

Q95: Which of the following intangible assets is

Q96: Match each statement with the correct term

Q103: Why would a taxpayer ever elect to

Q110: Contrast the facts and circumstances depreciation approach

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents