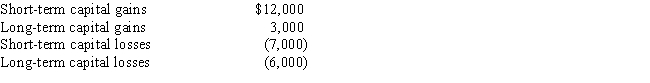

Morgan has the following capital gains and losses for the current tax year

What is Morgan's net capital gain or loss position for the year?

A) $5,000 net short-term capital gain.

B) $2,000 net long-term capital loss.

C) $2,000 net short-term capital gain.

D) $3,000 net long-term capital loss.

E) $4,000 net short-term capital loss.

Correct Answer:

Verified

Q25: Corky receives a gift of property from

Q31: Cathy owns property subject to a mortgage

Q34: In July 2016,Harriet sells a stamp from

Q35: In July 2016,Hillary sells a stamp from

Q36: Melissa sells stock she purchased in 2004

Q37: In September 2016,Eduardo sells stock he purchased

Q42: Raymond,a single taxpayer,has taxable income of $155,000

Q44: A taxable entity has the following capital

Q47: When a security becomes worthless

I.no loss can

Q53: Sidney,a single taxpayer,has taxable income of $45,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents