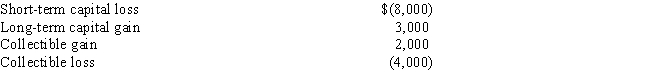

Serenity has the following capital gains and losses for the current year:

If Serenity is single and has taxable income from other sources of $75,000,what is the impact of her capital gains and losses on her income tax liability?

A) $690 decrease.

B) $750 decrease.

C) $840 decrease.

D) $1,050 decrease.

E) $1,960 decrease.

Correct Answer:

Verified

Q1: Allie, a well-known artist, gave one of

Q7: Section 1231 assets are certain trade or

Q11: Adjustments to gross selling price include

I.the amount

Q12: Brock exchanges property with an adjusted basis

Q22: Long-term capital gain classification is advantageous to

Q25: William has the following capital gains and

Q27: Gabrielle has the following gains and losses

Q29: When her property was fully depreciated and

Q30: A capital asset includes which of the

Q36: Courtney and Nikki each own investment realty

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents