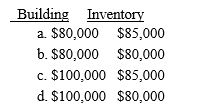

Dewey and Louie agree to combine their sole proprietorships into one business.They will be equal partners in the Dewlou Diner.Dewey will contribute a building worth $100,000 (adjusted basis of $80,000),and $10,000 in cash.Louie will contribute inventory worth $80,000 (adjusted basis of $85,000)and $30,000 cash.What is Dewlou's basis in the assets?

Correct Answer:

Verified

Q66: Nigel and Frank form NFS, Inc. an

Q68: Which of the following statements regarding a

Q72: Dewey and Louie agree to combine their

Q74: A fiscal year can be

I.a period of

Q75: Nigel and Frank form NFS, Inc. an

Q76: On January 5,2016,Mike acquires a 50% interest

Q78: During 2016,Mercedes incorporates her accounting practice.Mercedes is

Q80: Doug,Kate,and Gabe own Refiner Group,Inc.,an electing S

Q90: Terry and Elsa form Egret Company by

Q98: Determine the amount of income that Sarah

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents