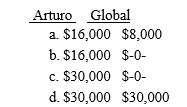

Global Corporation distributes property with a basis of $22,000 and a fair market value of $30,000 to Arturo in complete liquidation of the corporation.Arturo's basis in the stock is $14,000.What must Arturo and Global report as income upon the liquidation of Global?

Correct Answer:

Verified

Q63: Howard is a partner in the Smithton

Q64: Serenity receives a nonliquidating distribution from the

Q67: Posey Corporation distributes land with a fair

Q70: Boston Company, an electing S corporation, has

Q71: Anna owns 20% of Cross Co., an

Q71: The Serenity Corporation distributes $200,000 in cash

Q72: Peter owns 30% of Bear Company, an

Q73: On a nonliquidating distribution of cash from

Q75: Brooks Corporation distributes property with a basis

Q89: Louise is the marketing manager and a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents