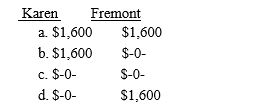

Karen receives the right to acquire 400 shares of Fremont Corporation stock through the company's incentive stock option plan.The fair market value of the stock at the date of the grant is $15 and the exercise price of the option is $19 per share.The fair market value of the stock at the date of exercise is $22.At the date of exercise,the tax consequences to Karen and the Fremont Corporation are

Correct Answer:

Verified

Q27: Ken is a 15% partner in the

Q32: Curtis is 31 years old, single, self-employed,

Q36: The maximum contribution that can be made

Q38: Posie is an employee of Geiger Technology

Q39: Alex is 37 years old,single and employee

Q42: Karl is scheduled to receive an annuity

Q43: On March 11,2014,Carlson Corporation granted Lana an

Q45: In 2016,Billie decides to purchase a house

Q46: A company that maintains a SIMPLE-401(k)has the

Q54: Pension plans are subject to excess contribution

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents