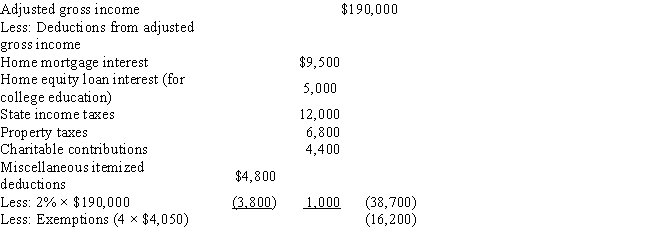

Rodrigo and Raquel are married with 2 dependent children,age 18 and 20,and reported the following items on their 2016 tax return:

Determine Rodrigo and Raquel's regular tax liability and,if applicable,the amount of their alternative minimum tax.

Correct Answer:

Verified

Q81: Abraham establishes a Roth IRA at age

Q82: Jane is a partner with Smithstone LLP.

Q83: Grand Corporation has $100,000 of U.S.source taxable

Q84: Match each statement with the correct term

Q89: Coffin Corporation (a domestic corporation)has $200,000 of

Q94: For the current year, Salvador's regular tax

Q94: Match the following statements:

-Alternative minimum tax

A)For the

Q94: Eileen is a single individual with no

Q95: Match each statement with the correct term

Q99: Gilberto is a Spanish citizen living in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents