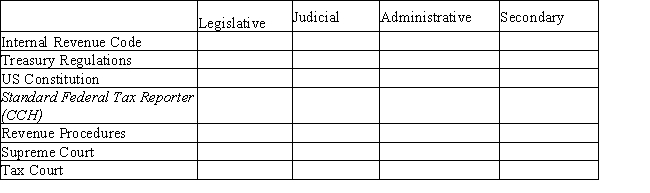

This problem requires determining the type of tax law authority and the relative importance within that authority category.Indicate "1" for the highest-ranking item within each category.Indicate "2" for the next-highest ranking item within each category.Each column may have zero,one,or more items ranked.

Correct Answer:

Verified

Q62: Which of the following Letter Rulings might

Q63: Which of the following is (are) secondary

Q65: All of the following are advantages of

Q68: How should the following citation be interpreted?

Q75: Which of the following is a permanent

Q77: Which of the following statements is correct?

I.The

Q78: Which of the following are numbered to

Q80: Citators

A)are primary authorities.

B)are not necessary for effective

Q83: Greene is an individual taxpayer residing in

Q91: Rewrite each of the following citations in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents