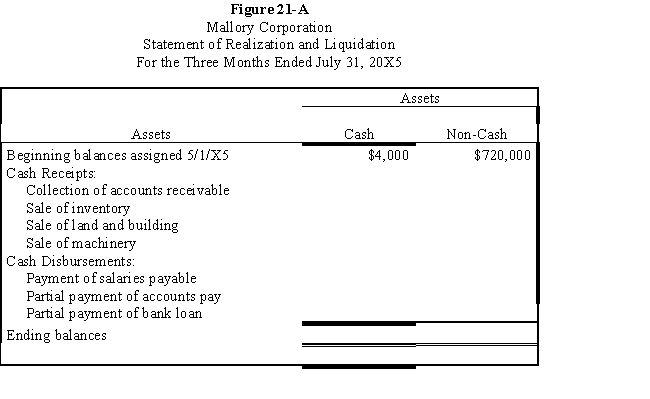

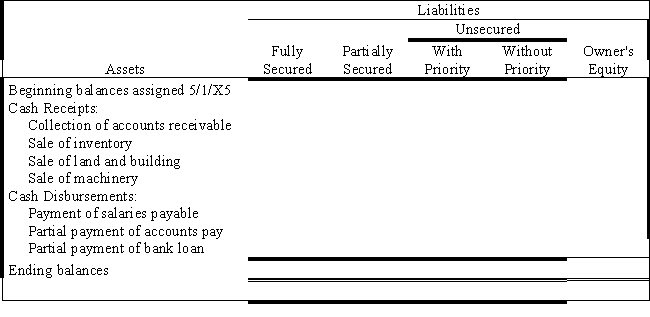

Mallory Corporation is being liquidated under Chapter 7 of the Bankruptcy Act.On May 1, 20X5, you are appointed the court's trustee for the liquidation.The book values for assets and liabilities, on May 1, 20X5, were as follows:

?

?

During May through July of 20X5, the following occurred:

?

The mortgage is secured by the land and building and the bank loan is secured by the machinery.The accounts payable are secured by the inventories.

?

Three-fourths of the accounts receivable were collected.Of the remaining accounts, $10,000 are believed to be uncollectible.

?

The inventories were sold for $170,000.

?

The land and building were sold for $20,000 and assumption of the mortgage.The machinery sold for $70,000 and the proceeds were remitted to the bank.

?

Salaries payable and $170,000 of the accounts payable were paid.

?

Required:

?

Complete Figure 21-A: Statement of Realization and Liquidation for May, June, and July of 20X5.

?

?

?

?

Correct Answer:

Verified

Q39: Hogan, Inc.is a telecommunications company.Currently, Hogan is

Q40: Which of the following is not true

Q41: As of June 30, 20X4, the

Q42: On June 1, 20X5, the books

Q43: Fresh-start accounting must be adopted by certain

Q44: On June 1, 20X5, the books

Q45: Differentiate by function the Accounting Statement of

Q46: On June 1, 20X5, the books

Q47: Describe the duties of the trustee in

Q49: Describe the options that are available to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents