On January 1,20X7,Jones Company acquired 90 percent of the outstanding common stock of Smith Corporation for $1,242,000.On that date,the fair value of noncontrolling interest was equal to $138,000.The entire differential was related to land held by Smith.At the date of acquisition,Smith had common stock outstanding of $520,000,additional paid-in capital of $200,000,and retained earnings of $540,000.During 20X7,Smith sold inventory to Jones for $440,000.The inventory originally cost Smith $360,000.By year-end,30 percent was still in Jones' ending inventory.During 20X8,the remaining inventory was resold to an unrelated customer.Both Jones and Smith use perpetual inventory systems.

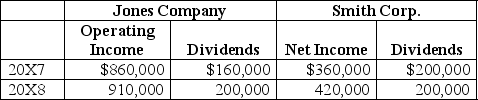

Income and dividend information for both Jones and Smith for 20X7 and 20X8 are as follows:

Assume Jones uses the modified equity method to account for its investment in Smith.

Required:

a.Present the worksheet consolidation entries necessary to prepare consolidated financial statements for 20X7.

b.Present the worksheet consolidation entries necessary to prepare consolidated financial statements for 20X8.

Problem 67 (continued)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q40: Potter Company acquired 75 percent ownership of

Q53: Parent Corporation owns 90 percent of Subsidiary

Q54: Parent Corporation owns 90 percent of Subsidiary

Q61: Colton Company acquired 80 percent ownership of

Q62: Pisa Company acquired 75 percent of Siena

Q63: Pisa Company acquired 75 percent of Siena

Q64: Hunter Company and Moss Company both produce

Q65: Pisa Company acquired 75 percent of Siena

Q67: On January 1,20X7,Jones Company acquired 90 percent

Q68: On January 1,20X7,Jones Company acquired 90 percent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents