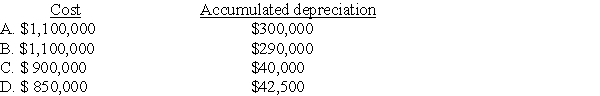

On January 1,20X1,Poe Corp.sold a machine for $900,000 to Saxe Corp.,its wholly-owned subsidiary.Poe paid $1,100,000 for this machine,which had accumulated depreciation of $250,000.Poe estimated a $100,000 salvage value and depreciated the machine on the straight-line method over 20 years,a policy which Saxe continued.In Poe's December 31,20X1,consolidated balance sheet,this machine should be included in cost and accumulated depreciation as:

Correct Answer:

Verified

Q10: Parent Corporation purchased land from S1 Corporation

Q18: A wholly owned subsidiary sold land to

Q20: Parent Corporation purchased land from S1 Corporation

Q26: A parent sold land to its partially

Q28: On January 1,20X9,Light Corporation sold equipment for

Q32: Pat Corporation acquired 80 percent of Smack

Q33: Pluto Corporation owns 70 percent of Saturn

Q34: Pluto Corporation owns 70 percent of Saturn

Q39: Pat Corporation acquired 80 percent of Smack

Q40: Plesco Corporation acquired 80 percent of Slesco

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents