The following data applies to Questions 1 - 3:

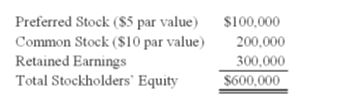

On January 1, 20X9, Company A acquired 80 percent of the common stock and 60 percent of the preferred stock of Company B, for $400,000 and $60,000, respectively. At the time of acquisition, the fair value of the common shares of Company B held by the noncontrolling interest was $100,000. Company B's balance sheet contained the following balances:

For the year ended December 31, 20X9, Company B reported net income of $100,000 and paid dividends of $40,000. The preferred stock is cumulative and pays an annual dividend of 10 percent.

For the year ended December 31, 20X9, Company B reported net income of $100,000 and paid dividends of $40,000. The preferred stock is cumulative and pays an annual dividend of 10 percent.

-Based on the preceding information,what will be the equity method income reported by Company A from its investment in Company B during 20X9?

A) $32,000

B) $30,000

C) $72,000

D) $48,000

Correct Answer:

Verified

Q1: Protective Corporation acquired 70 percent of the

Q4: Protective Corporation acquired 70 percent of the

Q9: Pooley Corporation owns 75 percent of the

Q10: Winner Corporation acquired 80 percent of the

Q11: Winner Corporation acquired 80 percent of the

Q12: Pail Corporation acquired 80 percent of the

Q13: The following data applies to Questions 1

Q15: Pail Corporation acquired 80 percent of the

Q17: Protective Corporation acquired 70 percent of the

Q19: Protective Corporation acquired 70 percent of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents