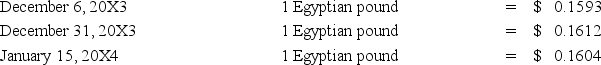

Highland Company sold goods to an Egyptian company for 350,000 Egyptian pounds on December 6,20X3,with payment due on January 15,20X4.The exchange rates were as follows:

-Based on the preceding information,what is Highland's overall net gain or net loss from its foreign currency exposure related to this transaction?

A) $280 loss

B) $302 loss

C) $385 gain

D) $665 gain

Correct Answer:

Verified

Q11: Suppose the direct foreign exchange rates in

Q12: Suppose the direct foreign exchange rates in

Q13: Suppose the direct foreign exchange rates in

Q14: On December 5,20X8,Texas based Imperial Corporation purchased

Q15: Suppose the direct foreign exchange rates in

Q17: Heavy Company sold metal scrap to a

Q18: Chicago based Corporation X has a number

Q19: Chicago based Corporation X has a number

Q20: Highland Company sold goods to an Egyptian

Q21: Myway Company sold equipment to a Canadian

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents