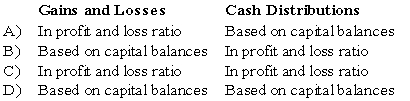

The CRT partnership has decided to terminate operations and to liquidate the partnership assets.There are no partner loans,and all partners have positive capital balances.Gains and losses on liquidation and cash distributions to partners should be allocated as follows:

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q1: When is a partnership considered to be

Q2: Bill,Page,Larry,and Scott have decided to terminate their

Q7: The following condensed balance sheet is presented

Q10: The balance sheet given below is presented

Q11: Bill,Page,Larry,and Scott have decided to terminate their

Q12: In order to avoid inequalities in the

Q13: Bill,Page,Larry,and Scott have decided to terminate their

Q18: The following condensed balance sheet is presented

Q19: Bill,Page,Larry,and Scott have decided to terminate their

Q20: The trial balance of WM Partnership is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents