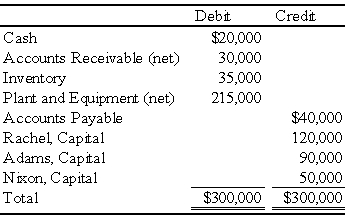

The partnership of Rachel,Adams,and Nixon has the following trial balance on September 30,20X9:

The partners share profits and losses as follows: Rachel,50 percent; Adams,30 percent; and Nixon,20 percent.The partners are considering an offer of $180,000 for the accounts receivable,inventory,and plant and equipment as of September 30.The $180,000 will be paid to creditors and the partners in installments,the number and amounts of which are to be negotiated.

The partners have decided to liquidate their partnership by installments instead of accepting the offer of $180,000.Cash is distributed to the partners at the end of each month.A summary of the liquidation transactions follows:

October

1.$25,000 is collected on accounts receivable; balance is uncollectible.

2.$20,000 received for the entire inventory.

3.$1,500 liquidation expense paid.

4.$40,000 paid to creditors.

5.$10,000 cash retained in the business at the end of the month.

November

6.$2,000 in liquidation expenses paid.

7.As part payment of his capital,Nixon accepted an item of special equipment that he developed,which had a book value of $8,000.The partners agreed that a value of $12,000 should be placed on this item for liquidation purposes.

8.$4,000 cash retained in the business at the end of the month.

December

9.$150,000 received on sale of remaining plant and equipment.

10.$1,000 liquidation expenses paid.No cash retained in the business.

Required:

Prepare a statement of partnership realization and liquidation with supporting schedules of safe payments to partners.

Problem 66 (continued):

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q50: The personal financial statements of a partner

Q51: On a partner's personal statement of changes

Q52: A partnership may be involved in "Dissociation"

Q54: Listen and Hear are thinking of dissolving

Q57: Partner A has a smaller capital balance

Q60: Partners David and Goliath have decided to

Q61: The partnership of Rachel,Adams,and Nixon has the

Q62: A personal statement of financial condition dated

Q65: On March 1,20X9,the ABC partnership decides to

Q66: When Disney and Charles decided to incorporate

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents