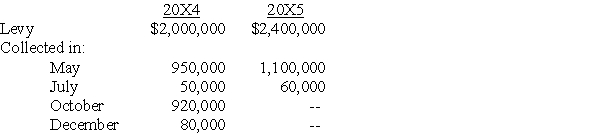

Pine City's year end is June 30.Pine levies property taxes in January of each year for the calendar year.One-half of the levy is due in May and one-half is due in October.Property tax revenue is budgeted for the period in which payment is due.The following information pertains to Pine's property taxes for the period from July 1,20X4,to June 30,20X5:

Calendar Year

The $40,000 balance due for the May 20X5 installments was expected to be collected in August 20X5.What amount should Pine recognize for property tax revenue for the year ended June 30,20X5?

A) $2,160,000

B) $2,200,000

C) $2,360,000

D) $2,400,000

Correct Answer:

Verified

Q23: Which of the following funds should use

Q24: Which of the following items is not

Q25: Under the modified accrual basis of accounting

Q26: Revenues from parking meters and parking fines

Q31: Assuming there is a budget surplus,which of

Q32: The Board of Commissioners of Vane City

Q35: The general fund of Gillette levied property

Q36: The general fund of the Town of

Q37: In a town's general fund operating budget

Q40: Under the modified accrual basis of accounting,revenue

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents