On January 1,20X1,Washington City received 200,000 from an estate with the stipulation that the money be invested and the income be used to provide maintenance to the city cemetery.The money was invested in 7% governmental securities at 90 to yield an effective interest rate of 10%.The following journal entry would be made to account for the accrued interest of the permanent fund:

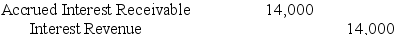

A)

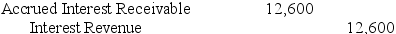

B)

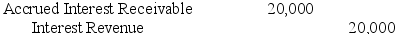

C)

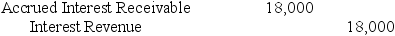

D)

Correct Answer:

Verified

Q20: Fixed assets and investments are reported in

Q22: For which of the following long-term debt

Q23: GASB 34 specifies two criteria for determining

Q23: The costs of enterprise fund activities are

Q24: On the statement of revenues,expenditures,and changes in

Q25: A debt service fund of Clifton received

Q27: Lisa County issued $5,000,000 of general obligation

Q29: What account should be debited in the

Q30: Arlington has a debt service fund which

Q38: A debt service fund for the City

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents