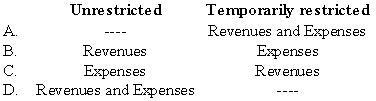

A not-for-profit organization received a donation temporarily restricted as to use.The donated amount was later spent in accordance with the restriction.In which category(ies)of net assets should the related revenues and expenses be recognized?

Correct Answer:

Verified

Q7: Which of the following is an example

Q15: A private not-for-profit university generally must depreciate

Q16: Gray College,a private not-for-profit institution,received a contribution

Q17: According to ASC 958,Not-For-Profit entities should recognize

Q18: Which rule-making body is currently setting standards

Q19: On the statement of activities for a

Q21: In 20X1,Ellen College,a private not-for-profit institution,received a

Q22: Unrestricted current funds of a private university

Q23: Bridger Hospital,which is operated by a religious

Q25: For the year ended June 30,20X9,a private

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents