On January 1,20X7,Gild Company acquired 60 percent of the outstanding common stock of Leeds Company at the book value of the shares acquired.On that date,the fair value of noncontrolling interest was equal to 40 percent of book value of Leeds.At the time of purchase,Leeds had common stock of $1,000,000 outstanding and retained earnings of $800,000.

On December 31,20X7,Gild purchased 50 percent of Leeds' bonds outstanding which were originally issued on January 2,20X4,at 99.The total bond issue has a face value of $600,000,pays 10 percent interest annually,and has a 10-year maturity.Any premium or discount is amortized on a straight-line basis.Gild paid $306,000 for its investment in Leeds' bonds and intends to hold the bonds until maturity.

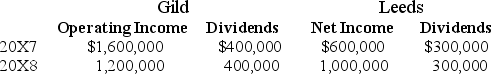

Income and dividends for Gild and Leeds for 20X7 and 20X8 are as follows:

Assume Gild accounts for its investment in Leeds stock using the cost method.

Required:

A)Present the worksheet consolidation entries necessary to prepare consolidated financial statements for 20X7.

B)Present the worksheet consolidation entries necessary to prepare consolidated financial statements for 20X8.

Problem 40 (continued):

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: Paper Corporation holds 80 percent of the

Q28: On January 1,20X7,Gild Company acquired 60 percent

Q28: Spice Company issued $200,000 of 10 percent

Q29: Hunter Corporation holds 80 percent of the

Q30: Spice Company issued $200,000 of 10 percent

Q31: Dundee Company issued $1,000,000 par value 10-year

Q31: Spice Company issued $200,000 of 10 percent

Q34: Spice Company issued $200,000 of 10 percent

Q36: Spice Company issued $200,000 of 10 percent

Q39: Paper Corporation holds 80 percent of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents