USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

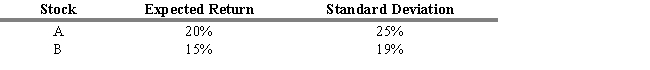

Stocks A and B have a correlation coefficient of -0.8. The stocks' expected returns and standard deviations are in the table below. A portfolio consisting of 40% of stock A and 60% of stock B is constructed.

-Refer to Exhibit 6.14. What is the expected return of the stock A and B portfolio?

A) 17.0%

B) 17.5%

C) 18.0%

D) 18.5%

E) 19.0%

Correct Answer:

Verified

Q68: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q69: In a two-stock portfolio, if the correlation

Q70: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q71: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q72: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q74: Given the following weights and expected security

Q75: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q76: Calculate the expected return for a three-asset

Q77: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q78: All of the following are common risk

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents