USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

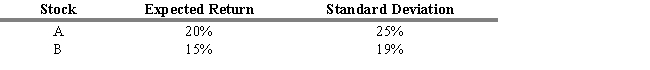

Stocks A and B have a correlation coefficient of -0.8. The stocks' expected returns and standard deviations are in the table below. A portfolio consisting of 40% of stock A and 60% of stock B is constructed.

-Refer to Exhibit 6.14. What percentage of stock A should be invested to obtain the minimum risk portfolio that contains stock A and B?

A) 35%

B) 42%

C) 58%

D) 65%

E) 72%

Correct Answer:

Verified

Q75: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q76: Calculate the expected return for a three-asset

Q77: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q78: All of the following are common risk

Q79: USE THE INFORMATION BELOW FOR THE

Q81: A portfolio is considered to be efficient

Q82: A positive covariance between two variables indicates

Q83: The most important criteria when adding new

Q84: Between 1990 and 2000, the standard deviation

Q85: Between 1980 and 2000, the standard deviation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents