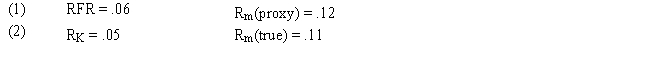

Assume that as a portfolio manager the beta of your portfolio is 1.4 and that your performance is exactly on target with the SML data under condition 1. If the true SML data is given by condition 2, how much does your performance differ from the true SML?

A) 2.0 percent lower

B) 0.5 percent lower

C) 0.5 percent lower.

D) 1.0 percent higher

E) 2.0 percent higher

Correct Answer:

Verified

Q58: Calculate the expected return for D Industries,

Q59: Calculate the expected return for F Inc.,

Q60: The betas for the market portfolio and

Q61: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q62: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q64: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q65: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q66: A friend has some reliable information that

Q67: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q68: Recently you have received a tip that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents